Welcome to Sparrowhawk Legal Your Leading Housing Disrepair Team...

Contact Us Now

CALL US: 0204 581 9300

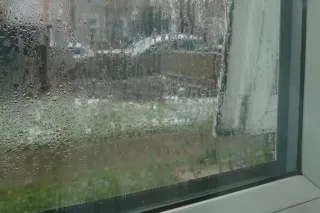

IS YOUR RENTAL PROPERTY SUFFERING FROM...

DAMP, MOULD, LEAKS, BROKEN OR ROTTING WINDOWS OR DOORS, INSECT OR VERMIN INFESTATIONS, ASBESTOS IN THE CEILING OR FLOORS... OR ANYTHING ELSE THAT MAKES YOUR HOME DANGEROUS OR UNPLEASANT TO LIVE IN? CALL OUR LEGAL EXPERTS TODAY - 0204 581 9300

We specialise in helping housing association and council tenants get the repairs to their homes done and the compensation they deserve.

Do you have a disrepair claim?

Take our free quiz to find out if you have a claim or book a call with our friendly Housing Disrepair Team

Your Specialist Housing Disrepair Team

Kelly Victoria Thorn

Nichola Turpin

Sarah Southworth

ALL OUR CLAIMS ARE NO WIN NO FEE = IF YOU DON'T GET PAID, WE DON'T GET PAID!

Your Rights as a Private Tenant When Living in Unsafe Conditions

A landlord has a basic duty to provide a safe and comfortable property to a tenant. But what are your rights if your home isn't safe to live in? ...more

Housing Disrepair

August 22, 2025•5 min read

Mould, Damp, and Mental Health: The Hidden Toll of Poor Housing

Mould and damp are one of the most common causes of housing disrepair, but the effects we sometimes don’t see is the impact on our mental health. ...more

Housing Disrepair

August 08, 2025•5 min read

Your Rights, Your Home: How to Speak Up About Housing Disrepair Without Fear

Many tenants, particularly those in social housing, feel afraid to speak up about ongoing repair issues. But with the right knowledge and support you can take action with confidence. ...more

Housing Disrepair

July 22, 2025•4 min read

TESTIMONIALS

What Our Clients Are Saying

FAQ's

We hope this information is useful, but if you have any further questions, please contact us.

What services does Sparrowhawk Legal offer?

At Sparrowhawk Legal, we specialise in providing legal support for tenants facing housing disrepair issues and offering guidance to responsible landlords. Our services include dispute resolution, legal advice, and advocacy aimed at ensuring safe and comfortable living conditions.

How can I access your services if I live outside of your local area?

As a fully virtual practice, we serve clients nationwide. Our online consultations and services allow us to assist you no matter where you are located, ensuring you receive the support you need from the comfort of your home.

What should I do if I am facing housing disrepair issues?

If you are experiencing disrepair in your home, contact us for a consultation. Our team will listen to your situation, provide tailored advice, and guide you through the process of resolving your issues effectively.

How do you support landlords?

We offer responsible landlords tailored advice and support to help them manage their properties confidently. Our expertise ensures that landlords are equipped to handle disputes and protect themselves from unjust claims.

What makes Sparrowhawk Legal different from other legal services?

We pride ourselves on our empathetic approach, transparent communication, and commitment to keeping clients informed throughout the legal process. Our virtual format allows us to operate efficiently and reduce costs, passing the savings onto you.

Can I join the "Women and Family Tenant Support" Facebook group?

Yes! Our Facebook group is open to anyone seeking support related to housing challenges. It’s a safe space for sharing resources, experiences, and advice. We encourage you to join and connect with others facing similar situations.

Do you help tenants with private landlords?

Yes. Wherever possible we will always help clients who have private landlords. We also help the good private landlords out there who are being targeted by disreputable claims management companies.

How much do you charge?

Our fees are usually covered by a no win no fee agreement in respect of housing disrepair claims and our success fee is capped at 33%. For landlords we offer a tailored fee structure dependent on the complexity of the case and the stage of the matter.

How do I get started?

To get started, simply reach out through our website or contact us directly for an initial consultation. We’ll discuss your situation and how we can assist you in achieving the best possible outcome.

Sparrowhawk Legal Ltd | Registered in England and Wales | Registered Company No: 14507943 | Registered office: 5th Floor 167-169 Great Portland Street, London, W1W 5PF | Tel 0204 581 9300

Sparrowhawk Legal Ltd is authorised and regulated by the Solicitors Regulation Authority No. 8004127

Sparrowhawk Legal is a trading name of Sparrowhawk Legal Ltd.

© Copyright 2024. Sparrowhawk Legal. All rights reserved.